Your home is one of your most valuable assets—not just financially, but emotionally. It’s where memories are made, where you find comfort, and where daily life unfolds. Protecting it is essential, and that’s where dwelling coverage comes in. Dwelling coverage is a core component of your home insurance policy, providing financial protection for the physical structure of your home when damage occurs from covered events.

Understanding what dwelling coverage includes, excludes, and how much you need is key to ensuring your home is fully protected.

What Is Dwelling Coverage?

Dwelling coverage is the part of your homeowners insurance policy that pays to repair or rebuild the physical structure of your home if it’s damaged by a covered loss. This includes:

- The foundation

- Walls and roof

- Built-in appliances

- Cabinets, flooring, and countertops

- Attached structures like garages and decks

In other words, dwelling coverage protects the main structure of your home—not just belongings inside it.

What Types of Damage Does Dwelling Coverage Protect Against?

Most standard homeowners policies cover your dwelling against specific events, also known as perils.

- Common Covered Perils Include:

- Fire and smoke damage

- Wind and hail

- Lightning strikes

- Explosions

- Vandalism

- Damage from falling objects

- Certain types of water damage (such as from burst pipes)

If one of these perils damages your home, dwelling coverage can pay to repair or rebuild the structure.

What Dwelling Coverage Does Not Cover

Understanding exclusions is just as important as knowing what’s covered.

Common Exclusions May Include:

- Flooding

- Earthquakes

- Pest damage (termites, rodents)

- Normal wear and tear

- Poor maintenance

- Sewer backup (unless added as an endorsement)

For example, flooding requires separate flood insurance—a critical policy to consider if you live in an area prone to heavy rain or coastal storms.

How Much Dwelling Coverage Do You Need?

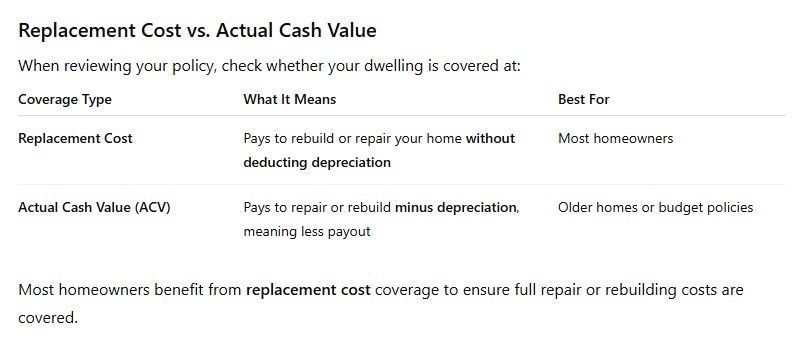

The amount of dwelling coverage on your policy should be based on the cost to rebuild your home, not its market value.

Key Factors That Influence Rebuilding Cost:

- Local construction labor rates

- Cost of building materials

- Home size and layout

- Architectural style and finishes

- Special features (stonework, hardwood floors, etc.)

This value is known as the reconstruction cost, which may be higher or lower than your home’s market price.

Rule of Thumb:

Make sure your dwelling coverage amount equals the full cost to rebuild, so you’re protected even in the event of a total loss.

Local Insight: Greenville, NC

Homeowners in Greenville, NC should pay attention to local weather patterns—such as hurricanes and severe thunderstorms—that commonly cause wind and water damage. Ensuring your dwelling coverage amount reflects local rebuilding costs can make a significant difference during recovery.

Optional Add-Ons to Enhance Dwelling Protection

Depending on your home and location, you may want to consider extra coverage types:

- Extended Replacement Cost: Adds an additional percentage (e.g., 25%) if rebuilding costs exceed your limit.

- Ordinance or Law Coverage:

Pays for bringing your home up to current building codes.

- Flood or Earthquake Insurance: Separate policies for areas prone to natural disasters.

These add-ons offer additional peace of mind, especially during major storms or unexpected reconstruction challenges.

Tips for Ensuring Adequate Dwelling Protection

- Review your policy annually—construction costs change.

- Notify your insurer about home upgrades (new kitchen, roof, or addition).

- Ask for a reconstruction cost estimate from your insurance agent.

- Consider bundling endorsements for better coverage flexibility.

Conclusion: Protecting Your Home Starts with the Right Coverage

Dwelling coverage is the foundation of your homeowners insurance policy, providing essential protection for the structure of your home. By understanding what it covers, how it works, and how to choose the right coverage amount, you can safeguard your home from unexpected damage and costly repairs.

If you’re unsure whether your current dwelling coverage meets your needs, now is a great time to review your policy. Ensuring your home is properly protected gives you peace of mind—no matter what storms may come your way.

At Alcock Insurance, we are committed to offering our clients a wide range of comprehensive and affordable insurance policies. We go above and beyond to ensure that we meet your unique needs with tailored solutions. To find out more about how we can assist you, please reach out to our agency at (252) 353-1700 or CLICK HERE to request a free, no-obligation quote.

Disclaimer: The content provided in this blog is for informational purposes only and should not be considered professional advice. For personalized guidance, it is important to consult with a qualified insurance agent or professional. They can offer expert advice tailored to your individual situation and help you make well-informed decisions about your insurance coverage.