When most drivers think of auto insurance, they imagine coverage for collisions — those stressful moments when fenders get bent or bumpers meet. But what about damage that happens when your car isn’t even moving? That’s where comprehensive auto insurance comes in.

Comprehensive coverage protects your vehicle from many types of damage unrelated to collisions, such as theft, vandalism, natural disasters, and more. It’s one of the smartest investments for drivers who want complete peace of mind on — and off — the road.

If you’re driving in Greenville, NC, where unpredictable storms and occasional thefts can pose risks to vehicles, understanding comprehensive auto insurance can help you choose the right protection for your situation.

What Is Comprehensive Auto Insurance?

Comprehensive insurance is an optional (but highly recommended) type of auto coverage that helps pay for repairs or replacement if your vehicle is damaged by events other than a collision.

It covers a wide range of incidents that are typically out of your control — meaning you won’t have to pay the full cost of repair or replacement on your own.

Key Takeaway:

Comprehensive coverage = protection from “non-collision” damages such as weather, theft, and vandalism.

What Comprehensive Insurance Covers

Comprehensive insurance provides protection for many unexpected situations. Here’s a breakdown of what’s typically included:

A. Weather-Related Damage

- Hailstorms: Dents and cracked windshields from hail impact.

- Flooding: Water damage to your car’s engine, interior, or electrical system.

- Fallen Trees or Debris: Windstorms or hurricanes can cause trees or objects to fall onto your car.

- Lightning or Fire: Damage caused by lightning strikes or vehicle fires.

In areas like Greenville, NC, where hurricanes and tropical storms can roll through during certain seasons, this coverage can save you from expensive repair bills.

B. Theft and Vandalism

- Vehicle Theft: Covers the cost if your car is stolen and not recovered.

- Vandalism: Covers damage such as broken windows, graffiti, or slashed tires.

C. Animal Collisions

If you hit an animal — such as a deer or stray pet — the resulting damage falls under comprehensive coverage (not collision insurance).

D. Glass and Windshield Damage

Comprehensive coverage often includes repairs or replacement for cracked or shattered glass caused by road debris, hail, or vandalism.

E. Fire and Explosions

Whether caused by an engine malfunction or an external source, fires can destroy a vehicle — and comprehensive insurance helps cover repair or replacement costs.

F. Civil Disturbances

Damage from riots or civil unrest, including broken windows or body damage, is also typically covered.

What Comprehensive Insurance Does Not Cover

While comprehensive coverage is broad, it doesn’t cover everything. Knowing its limitations helps you avoid surprises.

It Does NOT Cover:

- Collision Damage:

Accidents involving another vehicle or object (that’s covered by collision insurance).

- Wear and Tear:

Regular maintenance issues like brake wear or oil changes.

- Mechanical Failures:

Engine breakdowns or transmission issues unrelated to covered events.

- Personal Belongings: Items stolen from your vehicle (like laptops or phones) are usually covered under a home or renters insurance policy.

How Comprehensive Insurance Works

When you experience a covered loss:

- File a Claim:

Notify your insurer as soon as possible with details and photos of the damage.

- Pay the Deductible: You’ll be responsible for your chosen deductible amount (e.g., $500 or $1,000)

- Insurer Covers the Rest: The insurance company pays the remaining cost to repair or replace your vehicle, up to its actual cash value (ACV).

Example:

If a hailstorm causes $3,000 in damage to your car and your deductible is $500, you pay $500, and your insurer covers the remaining $2,500.

Comprehensive vs. Collision: What’s the Difference?

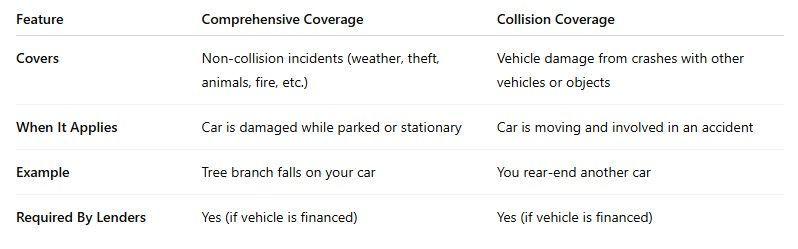

Drivers often confuse these two types of coverage, but they protect against very different risks.

Most drivers carry both comprehensive and collision coverage for complete protection.

When Comprehensive Coverage Is Worth It

Comprehensive coverage makes sense for many drivers, but especially in these situations:

- You finance or lease your car: Most lenders require it until the loan is paid off.

- You live in an area prone to severe weather: Hurricanes, hail, and floods make it essential in places like Greenville, NC.

- You park outside frequently: Risk of vandalism, falling objects, or theft increases.

- Your vehicle has significant value: Replacing a newer or higher-end car without coverage can be costly.

If your car is older and its value is low, you might decide to drop comprehensive coverage — but always compare the potential repair cost with your premium savings first.

How Much Does Comprehensive Insurance Cost?

The cost of comprehensive coverage varies depending on several factors:

- Vehicle value and age

- Location (urban vs. rural)

- Deductible amount (higher deductible = lower premium)

- Claims history

- Weather risks

In Greenville, NC, average comprehensive coverage costs tend to be moderate, but they can increase in high-risk weather zones or for newer vehicles.

You can reduce costs by:

- Bundling policies (auto + home insurance)

- Maintaining a clean driving record

- Installing anti-theft devices

- Choosing a higher deductible

Tips for Getting the Most Out of Comprehensive Coverage

- Check for Overlaps:

Avoid paying for coverage already included in other policies.

- Review Annually: Update your policy to reflect changes in vehicle value or lifestyle.

- Document Everything:

Keep photos and records to support claims.

- Ask About Glass Coverage:

Some insurers offer zero-deductible options for windshield repairs.

- Work with a Local Agent: Agents familiar with Greenville, NC can recommend coverage that fits your environment and budget.

Why Comprehensive Insurance Is So Valuable

Even the most cautious drivers can’t control every risk. Comprehensive coverage provides financial protection against unpredictable events — from a cracked windshield to a total loss after a storm.

Top Benefits:

- Peace of Mind: Covers a wide range of non-collision risks.

- Financial Protection: Prevents large out-of-pocket expenses.

- Lender Compliance: Required for financed or leased vehicles.

- Added Resale Value: Vehicles repaired under insurance retain higher market value.

Conclusion

Comprehensive auto insurance goes far beyond accidents — it protects your car from the unexpected, whether it’s a storm, theft, or vandalism. While it’s optional in many states, it’s often an essential part of a well-rounded policy, especially for anyone who wants complete protection.

If you’re in Greenville, NC, consider talking to a local insurance professional to explore how comprehensive coverage fits into your auto insurance plan. With the right policy in place, you can drive (and park) with confidence — knowing your vehicle is protected no matter what life throws your way.

At Alcock Insurance, we are committed to offering our clients a wide range of comprehensive and affordable insurance policies. We go above and beyond to ensure that we meet your unique needs with tailored solutions. To find out more about how we can assist you, please reach out to our agency at (252) 353-1700 or CLICK HERE to request a free, no-obligation quote.

Disclaimer: The content provided in this blog is for informational purposes only and should not be considered professional advice. For personalized guidance, it is important to consult with a qualified insurance agent or professional. They can offer expert advice tailored to your individual situation and help you make well-informed decisions about your insurance coverage.